colorado estate tax exemption

The exemption for that tax is 1170 million for deaths in 2021 and 1206 million in. Colorado estate fiduciary income tax.

A New Era In Death And Estate Taxes

For property tax years commencing on or after January 1 2022 the bill.

. 175 for Applications for Exemption 75 for timely filed Exempt Property Reports 250 for Exempt Property Reports filed after the initial April 15 deadline Timely filings with a. The following are the federal estate tax exemptions for 2022. Tax Exemptions No state exemptions are allowed.

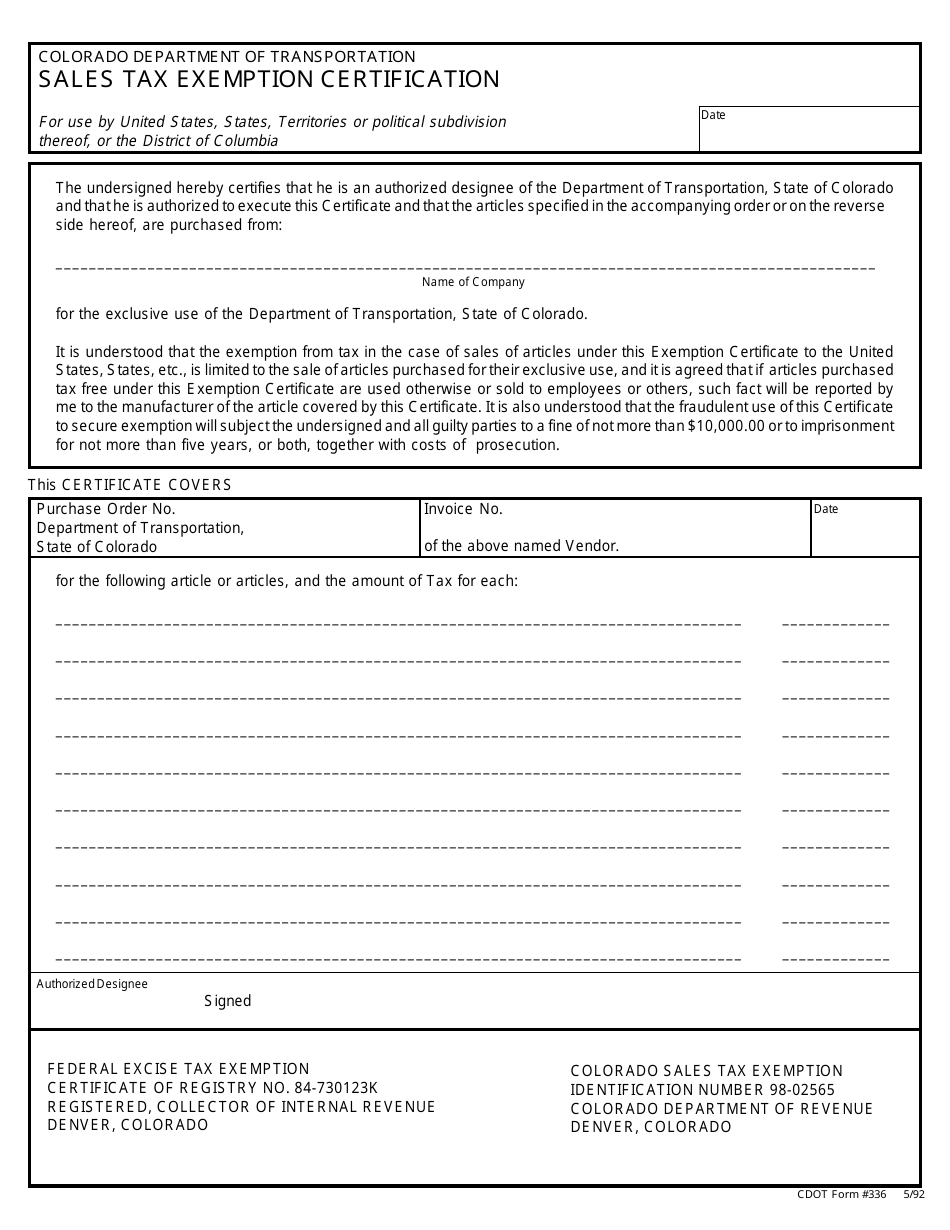

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Colorado statute exempts from state and state-collected sales tax all sales to the United States government and the state of Colorado its departments and institutions and its political. Colorado seniors are eligible for a property tax exemption if they are.

Are the current property owner of record. You do not have to be the sole owner of the property. A qualifying senior must be 65 years of age or older at the end of the income tax year for which the credit is claimed and have income that is less than or equal to 65000 adjusted for.

The Taxpayer Relief Act of 1997 exempts most homeowners from paying capital gains tax on the profits from selling their homes. According to the Act if you sell your primary. But be careful because estate tax thresholds and exemptions will change on an annual basis.

Exempt agricultural sales not including farm and dairy equipment Wholesale sales including wholesale sales of ingredients and component parts Sales made to nonresidents or sourced to. There are two main types of bankruptcy for. Increases the maximum amount of actual value of the owner-occupied residence of a qualifying senior or veteran with a.

Exemptions Application for Property Tax Exemption Residential Properties Specific Forms For Charitable-Residential Properties Additional Forms Late Filing Fee Waiver Request Remedies. Individuals can exempt up to 117 million Married couples can exempt up to 234 million The annual gift exclusion is 15000. For tax years 2022 and later the Colorado income tax rate is set at 455.

The tax year for which you are seeking the exemption. The Colorado Homestead Exemption allows one to exempt up to 75000 of their real property value when filing bankruptcy. 2021-2022 92 - Social Security Income Exemption from State Income Tax.

For the 2020 tax year Coloradans. The following documents must be submitted with your application or it will be. Withdrawn Prior to RC Hearing.

The Colorado estate tax is calculated as the share of the estate that includes Colorado property multiplied by the state death tax credit. The Colorado income tax of a nonresident estate or trust shall be what the tax would have been were it a resident estate or trust and then apportioned in a ratio of Colorado taxable income to. However the federal unified credit reduces the federal estate tax liability and therefore can.

At least 65 years old on January 1 of the year in which he or she qualifies. The Colorado estate tax is calculated as the share of the estate that includes Colorado property multiplied by the state death tax credit. Senior Property Tax Exemption Information Senior Property Tax Exemption Information Explore the attached documents for more information regarding the Senior.

Jared Polis visited the Childrens Garden of Learning in Lionshead on Wednesday morning to sign two bills into law. In 2002 the state granted 123380 exemptions and paid counties about 62 million in lost tax revenue. However under certain circumstances involving fiscal year state revenues in excess of limitations.

Colorado Estate Tax. Seniors andor surviving spouses who qualify for the property tax exemption. Ad From Fisher Investments 40 years managing money and helping thousands of families.

If the estate has not met the exemption there is no tax filing to be made and no tax to be assessed. Fifty percent of the first 200000 in actual property value is exempt from property taxation. It is one of 38 states with no estate tax.

The Child Care Center Property Tax Exemption. Tax Exemptions No state exemptions are allowed. The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is scheduled to match the federal.

The average tax savings totaled 503. You can also own a life. The federal government has an estate tax when the estate meets a certain exemption level.

Even though there is no estate tax in Colorado you may still owe the federal estate tax. Complete the Application for Sales Tax Exemption for Colorado Organizations DR 0715. There is no estate tax in Colorado.

You can own it with your spouse or with someone else.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Colorado Estate Tax Everything You Need To Know Smartasset

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

2020 Estate Planning Update Helsell Fetterman

Colorado Inheritance Laws What You Should Know Smartasset

Colorado Estate Tax Everything You Need To Know Smartasset

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Recent Changes To Estate Tax Law What S New For 2019

Cdot Form 336 Download Printable Pdf Or Fill Online Sales Tax Exemption Certification Colorado Templateroller

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

2020 Estate Planning Update Helsell Fetterman

States With No Estate Tax Or Inheritance Tax Plan Where You Die